The Discipline Layer of USD.AI

Time-to-Onramp and the Architecture of Trust

A progress report on GPU loans: Delayed

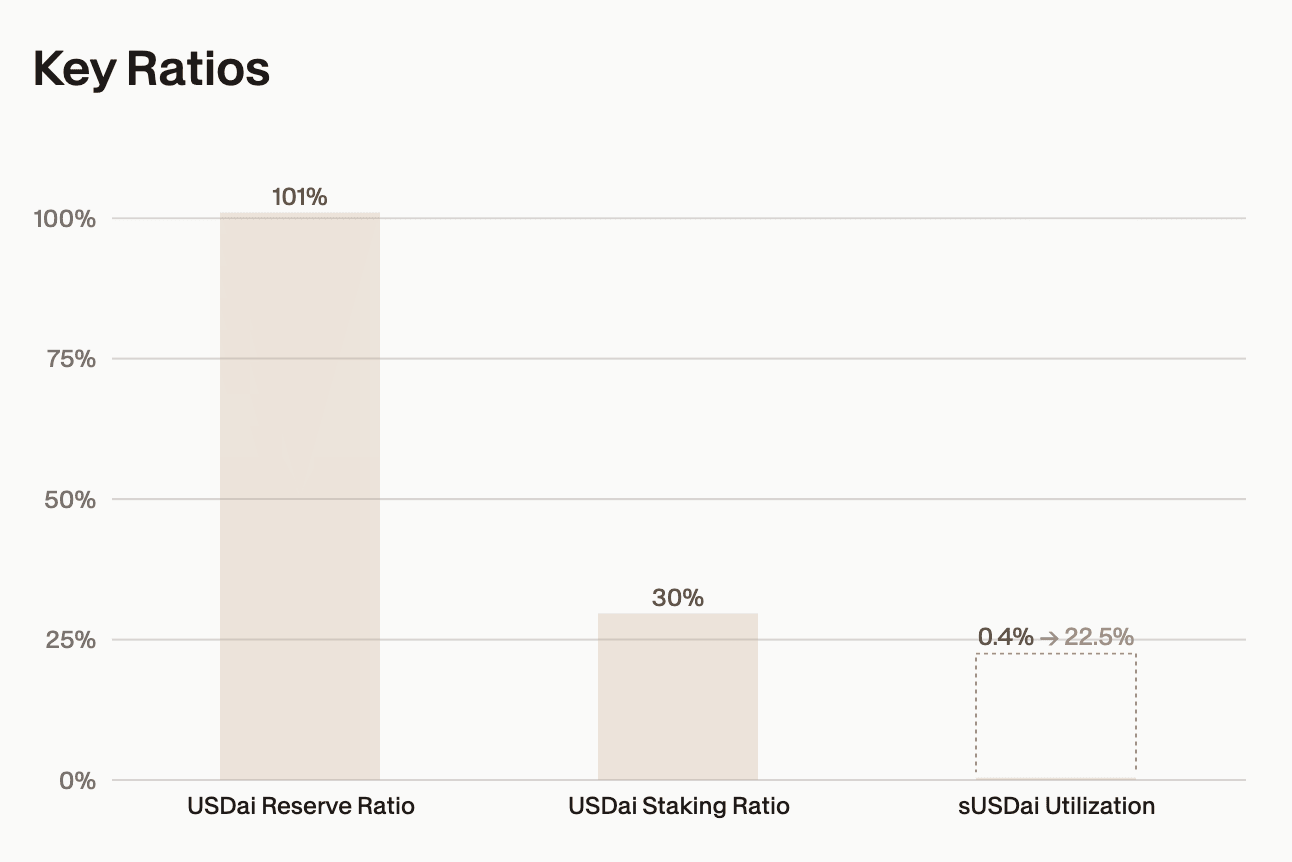

It's been ~2 months since we launched and our reserves page is showing that we are 99.9% T-Bills still. Yep. This is true. It’s not because we aren’t able to facilitate enough GPU loans, but rather that the speed of the loans is in terms of weeks, not days. We call this “time-to-onramp” (TtO) the gap period between when the borrower signals their intention to use USD.AI to when they are issued the GWRT and initiate the borrow onchain.

The slower TtO is also the reason why we’ve had deposit caps on USDai and sUSDai. The protocol has only existed for 2 months, gaining massive traction much faster than we expected. Even with this breakneck speed of stablecoin deposits, and signing deals, a signature doesn't mean that the yield suddenly appears.

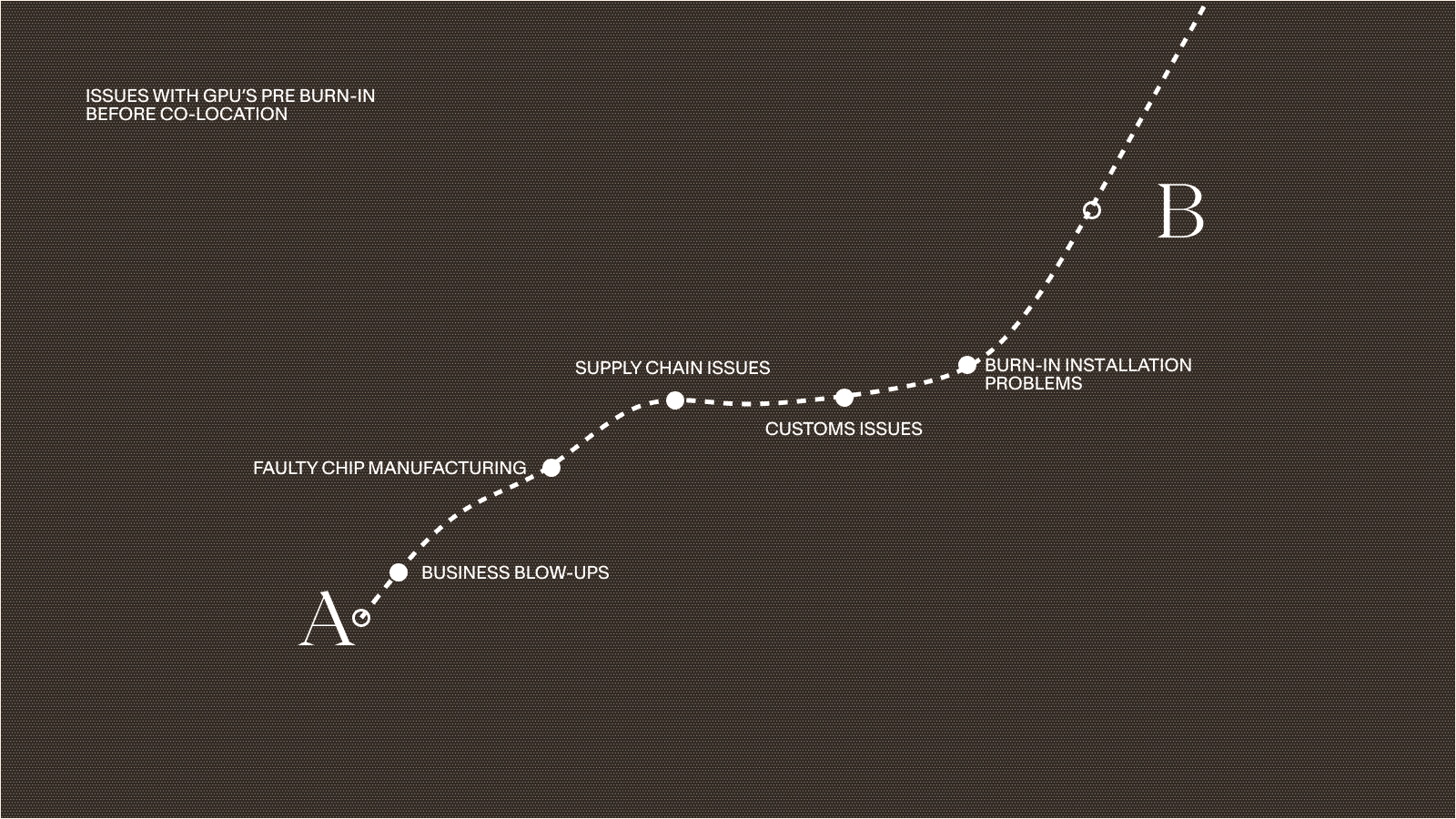

Here’s an example of irl problems we’re experiencing. Two weeks ago, a shipment of NVIDIA B200s sat in French customs after leaving Taiwan. They had been set to arrive, be installed and then issued a GWRT using USD.AI. It’s one of the first deals we ever facilitated, and yet, 10 weeks after launch, its not live yet due to these customs issues.

While the delay for customs might be routine, it would have been a big negative had the protocol also been providing purchase order financing or other insurance on the chips before they were installed.

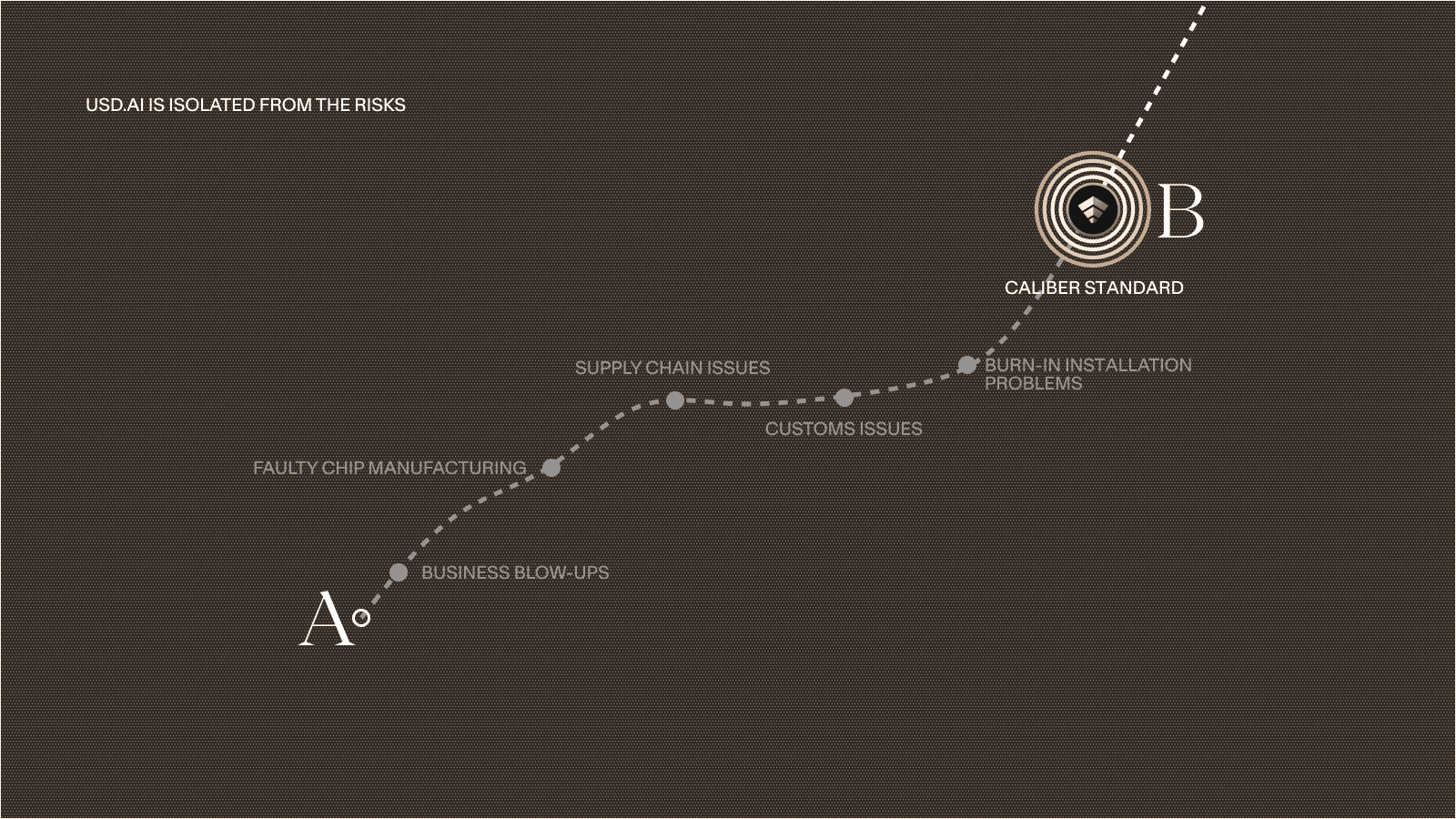

That is precisely why CALIBER exists, and why our process moves slower - because we ONLY start the loan after “Burn-In” or after installation. It’s the only way we can ensure USD.AI functions properly.

There are no shortcuts to radical visibility.

Permian Lab’s role as issuer of the GWRTs is the one trust-based function in USD.AI’s architecture. Everything else is governed by code and contracts. But minting the CALIBER NFT, the electronic document of title, is where discipline lives. It is where human verification meets on-chain certainty.

Under CALIBER, capital does not move until that point. Not when the order is signed. Not when the crate ships. Only after the GPUs are delivered, installed, and burned in, when serial numbers, SSH access, and bailee confirmations are complete. Only then does Permian mint the token that represents real property.

This process is conservative by design. It avoids the fragility of financing promises and replaces it with verifiable proof of what exists, where it operates, and who holds title. It trades speed for certainty, a choice that defines how we intend to scale this market responsibly.

We could have moved faster, financing businesses or reputations. Instead, we chose to trust the metal and the metal only. Each GPU is a small act of verification, a brick in a ledger of real assets that anyone can audit.

The long road is frustrating, but it is the only one that holds up under stress. Property rights are now live on-chain, and every one begins with discipline.

Transparency takes time.