7-Day GPU Financing with USD.AI

How to finance your GPU cluster in 7 Days with USD.AI

GPU financing traditionally takes 60 to 90 days through banks or equipment lenders, creating bottlenecks that can cost AI infrastructure operators critical market opportunities and customer contracts. Operators who want to start the process can begin with the borrower intake at GPULoans.com, which aggregates financing requests for USD.AI’s underwriting pipeline. USD.AI compresses this timeline to under a week by combining blockchain tokenization with non-recourse, asset-backed lending that treats GPUs as liquid collateral rather than illiquid fixed assets.

This article walks through the complete financing process, from SPV formation and collateral verification to loan execution and operational integration, while comparing tokenized GPU financing against traditional lending options and explaining how non-recourse terms protect founders from personal liability.

Why GPU Cluster Financing Needs A Faster Approach

Financing a GPU cluster through USD.AI involves using a specialized decentralized finance platform that offers programmatic, asset-backed loans with GPUs as collateral. The process typically compresses what traditionally takes months into a seven-day workflow by combining blockchain tokenization with physical asset management, creating faster and more automated approvals than conventional financing methods.

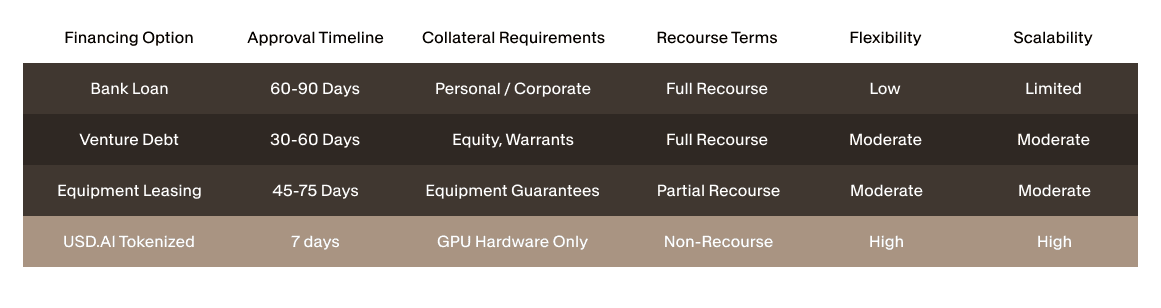

Traditional GPU financing creates bottlenecks that slow down AI infrastructure deployment. Bank loans typically take 60 to 90 days for approval, requiring extensive credit checks, personal guarantees, and corporate financial reviews that delay hardware procurement. Meanwhile, venture debt often demands equity warrants or board seats, diluting founder ownership before the first GPU even arrives.

The AI hardware market moves quickly, making these delays costly. A 90-day financing cycle can mean missing critical customer contracts, falling behind competitors in model training, or losing access to scarce GPU inventory during supply shortages. For AI startups and infrastructure operators, speed isn't just convenient—it's competitive.

Equipment leasing companies understand GPU hardware better than traditional banks, yet they still operate on 45 to 75-day timelines with complex documentation. Even after approval, many lenders require personal guarantees or corporate recourse, exposing founders to risk beyond the hardware itself. This creates a mismatch between the pace of AI innovation and the speed of capital deployment.

Comparing Traditional Loans And Tokenized GPU Financing

Each financing method carries different trade-offs in speed, collateral requirements, and liability exposure. Understanding your options helps you choose the right capital structure for your deployment timeline and risk tolerance.

Tokenized GPU financing changes how collateral gets verified and transferred. Traditional lenders spend weeks conducting physical audits, title searches, and legal reviews to confirm asset ownership. USD.AI uses blockchain technology to create GPU Warehouse Receipt Tokens (GWRTs) that represent verified ownership of specific hardware units, enabling instant verification without repeated physical inspections.

This tokenization creates transparency that reduces legal friction on both sides. Lenders can verify collateral authenticity and location in real-time through on-chain records, while borrowers maintain operational control of their hardware through a bailment structure. The result is a financing process that moves at the speed of hardware deployment rather than the pace of paperwork processing.

The liquidity advantage becomes clear when you scale quickly. Traditional lenders often cap exposure to single borrowers or require new underwriting for additional tranches, creating bottlenecks as your cluster grows. USD.AI's tokenized approach allows you to finance GPU purchases incrementally as hardware becomes available, matching capital deployment to your actual build schedule.

Understanding Loan To Value And Non-Recourse Terms

The loan-to-value (LTV) ratio measures how much you can borrow against your GPU hardware's appraised value. USD.AI typically offers a 70-80% LTV, meaning a cluster appraised at $10 million qualifies for $7-8 million in financing. This ratio balances lender risk protection with borrower capital efficiency, providing substantial leverage without over-collateralization.

Non-recourse financing means the lender's claim is limited exclusively to the GPU hardware serving as collateral. If you default on the loan, the lender can seize the GPUs but cannot pursue your other business assets, personal property, or corporate bank accounts. This structure differs fundamentally from traditional loans where lenders often require personal guarantees or blanket liens on all company assets.

For AI infrastructure builders, non-recourse terms provide crucial downside protection. You're already taking technical risk on hardware utilization, market risk on compute pricing, and operational risk on data center performance. Non-recourse financing ensures that if those risks materialize unfavorably, your liability remains bounded to the hardware investment itself rather than cascading into broader financial obligations.

The trade-off for non-recourse terms typically appears in pricing or LTV ratios. Lenders charge slightly higher rates or offer lower advance rates to compensate for their limited recourse in default scenarios. However, many founders consider this premium worthwhile for the peace of mind and balance sheet protection that non-recourse structures provide.

How The 7 Day Funding Timeline Works

The accelerated timeline depends on preparation and parallel processing of tasks that traditional lenders complete in sequence. Seven days is an ambitious benchmark, but the USD.AI workflow condenses a multi-month process into a single week when borrowers have the required components in place.

1. Application And SPV Formation

Borrowers begin by forming a dedicated special purpose vehicle (SPV) to hold GPU assets and interface with the financing process. The SPV creates bankruptcy remoteness, keeping the hardware legally distinct from other corporate assets. Delaware is the preferred jurisdiction due to its established commercial framework and support for tokenized documentation of title.

Required materials include:

- Company formation documents

- Identification for KYC compliance

- Data center agreements

- Proof that GPUs have been installed at an accredited facility, and evidence that the hardware has completed burn-in and is generating verifiable telemetry.

USD.AI originates credit only against GPUs that are active, on-site, and operating under a valid datacenter bailment. Purchase order financing is not part of the lending process. For groups that need help acquiring hardware, USD.AI can connect them with OEM partners and brokers, and can help source purchase-order financing through external partners. Once hardware is delivered, installed, and validated, the SPV issues electronic warehouse-receipt tokens that represent the collateral for the credit position.

Having the SPV formed and the hardware already online is the single largest driver of a fast underwriting cycle, and can remove two to three days from the timeline.

2. Collateral Verification And Valuation

GPU Warehouse Receipt Tokens (GWRTs) serve as the digital representation of your physical hardware. Each token corresponds to specific GPU units—serial numbers, models, and locations are all recorded on-chain. This tokenization happens after verification confirms that the hardware exists, matches the specifications claimed, is installed and is properly insured.

Verification procedures vary based on hardware location and deployment status. For GPUs already installed in data centers, USD.AI uses remote attestation through data center partners or software.

Enterprise-grade units like NVIDIA A100s, B200s and H100s are the most commonly financed models due to their established market value and strong secondary market liquidity. Valuation reflects current market rates adjusted for hardware condition, age, and model. GPU prices can be volatile, particularly for the latest generation chips, so USD.AI uses conservative appraisals that account for potential depreciation over the loan term.

3. Loan Execution And Disbursement

Once collateral is verified, installed, and valued, smart contracts automate the actual loan issuance and fund transfer. The SPV pledges its GWRTs to USD.AI's protocol, which releases USDC stablecoins to your designated wallet address. This on-chain execution can be completed immediately after being issued, eliminating the wire transfer delays and escrow complications common in traditional closings.

USDC stablecoins can be converted to fiat currency through Coinbase’s institutional or business accounts or used directly for hardware purchases from vendors who accept stablecoin payments. Transaction fees for the on-chain components are minimal, only a couple of cents for “gas” is necessary to complete the onchain transaction, making the process cost-effective even for smaller deployments.

The full process from application to disbursement can complete in seven days when borrowers have an SPV established, documentation prepared, and GPUs already installed at an accredited datacenter. Situations that require additional coordination—for example, multi-site installations or hardware that has not yet completed burn-in—can extend the timeline to 10–14 days. The protocol does not finance purchase orders, and timelines begin only once GPUs are physically deployed and eligible for verification.

Safeguarding Your Collateral With Insurance And Tokenization

Comprehensive insurance coverage protects both lenders and borrowers against physical loss, theft, equipment failure, and operational risks. USD.AI requires that all financed GPUs carry insurance policies naming both the SPV and the lender as beneficiaries, ensuring that hardware damage or loss doesn't leave either party unprotected. Policies typically cover the full replacement value of the hardware, not just the outstanding loan balance.

Tokenization provides transparent, verifiable records of ownership and collateralization that reduce disputes and streamline asset transfers. Every GWRT contains metadata about the underlying GPU—its serial number, model, location, insurance policy number, and lien status. This information lives on-chain where both parties can verify it independently, eliminating the ambiguity that often surrounds physical asset collateral in traditional lending.

Security measures extend beyond insurance to include secure custody arrangements that give borrowers operational access while maintaining legal security for lenders. The bailment structure means you retain physical possession and can operate the GPUs for your AI workloads, but the SPV holds legal title and has pledged that title to USD.AI as collateral.

This custody model solves a key challenge in GPU financing—lenders need security over the collateral, but borrowers need to actually use the hardware to generate the revenue that repays the loan. The bailment structure and tokenized tracking enable both requirements simultaneously, avoiding the operational friction that makes traditional asset-based lending impractical for actively deployed compute infrastructure.

Future Proofing GPU Investments Without Equity Dilution

USD.AI's model enables companies to scale AI infrastructure without surrendering equity or control to investors. For founders who have already raised venture capital, preserving remaining ownership becomes increasingly important as valuations grow. Debt financing allows you to maintain your cap table while still accessing the capital needed for hardware expansion.

The non-dilutive nature of debt financing means you retain 100% of the upside from your company's growth. If your AI infrastructure business scales successfully, you don't have to share that success with additional equity investors who came in during a hardware financing round. You simply repay the loan according to its terms and keep the full value creation for existing shareholders.

Technology refresh cycles also become more manageable with debt financing. As newer GPU models become available, you can sell older hardware, pay down existing loans, and finance new equipment purchases through additional USD.AI transactions. This creates a sustainable upgrade path that keeps your infrastructure competitive without requiring new equity raises for each hardware generation.

Integrating Rapid Funding Into AI Infrastructure

Coordinating financing with hardware procurement and data center readiness maximizes the value of fast capital deployment. The seven-day financing timeline only delivers real value if you already have the GPUs deployed and burned in a compliant data center. This requires advance planning around rack space, power allocation, cooling capacity, and network connectivity at your chosen data center.

Best practices include confirming delivery timelines with hardware vendors before initiating the financing process. GPU lead times vary significantly based on model, quantity, and supplier relationships. Having binding purchase orders or confirmed allocation from OEMs ensures that hardware arrives and is installed on schedule, avoiding situations where you're paying purchase order financing interest on funds sitting idle while waiting for delayed shipments.

Operational readiness checklists help you avoid deployment bottlenecks:

- Rack space and power: Confirm your data center has available capacity for the incoming hardware

- Network connectivity: Verify that bandwidth and network architecture can support your cluster's requirements

- Installation logistics: Arrange for shipping, receiving, and technical staff to rack and configure equipment

- Compliance and permits: Ensure all local regulations and data center requirements are satisfied before hardware arrives

Pre-arranging operational elements means you can move from funding to productive deployment in days rather than weeks. The speed advantage of USD.AI financing only matters if you're prepared to capitalize on it through parallel preparation of your physical infrastructure.

Accelerate Growth With Turnkey GPU Financing

USD.AI’s secured credit framework is designed to help AI infrastructure operators access rapid, non-dilutive financing for GPU expansion. Stablecoin liquidity provides global operating flexibility, and the system now integrates with Coinbase Institutional to support borrowers who operate primarily in traditional financial environments.

Through Coinbase Prime, borrowers can receive credit proceeds, hold stablecoins, convert them into dollars, and make amortizing payments without prior experience with digital assets. This removes settlement friction, shortens funding timelines, and preserves cash flow visibility for operators scaling across multiple regions.

Non-recourse terms reduce personal exposure for founders and operators while maintaining capital efficiency on hardware assets. This structure supports risk management in an environment shaped by shifting utilization rates, hardware cycles, and variable compute pricing.

Explore USD.AI's financing options to unlock fast, flexible capital and maintain your competitive position in the AI infrastructure market.

Frequently Asked Questions About GPU Financing

How are GPU assets physically secured while being used as collateral?

GPU assets are held in a bailment structure where you maintain physical possession and operational control while the SPV holds legal title pledged to USD.AI. This arrangement is documented through warehouse receipts and enforced through data center custody agreements that recognize the lender's security interest while permitting your operational access.

What happens if I need to upgrade my GPUs during the financing term?

USD.AI allows hardware upgrades through a structured process where you can sell existing GPUs, use proceeds to pay down the corresponding loan portion, and finance replacement hardware through a new transaction. This flexibility enables you to refresh your infrastructure as technology evolves without being locked into obsolete hardware for the full loan term.

Can I use USD.AI financing for data center costs beyond just GPUs?

USD.AI financing focuses specifically on GPU hardware as the collateral asset. However, some related infrastructure components like high-performance networking equipment or specialized cooling systems may be considered on a case-by-case basis if they're integral to the GPU cluster's operation and can be clearly valued and verified.

What documentation do I need to prepare before applying for GPU financing?

You'll need company formation documents for your SPV, proof of GPU purchase through invoices or binding purchase orders, identification and KYC information for beneficial owners, and data center agreements showing where hardware will be housed. Having insurance quotes or policies ready also accelerates the process, though USD.AI can help arrange appropriate coverage if needed.